Best Investment Locations in Dubai 2025: Where Smart Money is Flowing

Why Dubai's Real Estate Market is Set for Growth in 2025

Dubai's property market continues to defy global trends, with analysts predicting 10-15% price appreciation in prime areas through 2025. The city's tax-free status, golden visa program, and economic diversification make it a magnet for global investors seeking stable returns.

Top 5 Investment Hotspots for 2025

1. Palm Jumeirah - The Forever Prime

2025 Outlook:

- Limited new supply maintains exclusivity

- Villa prices expected to reach AED 4,000-6,500 psf

- Luxury rental yields holding at 5-6.5%

- New waterfront developments launching

Investment Tip: Focus on West Crescent for best capital growth potential

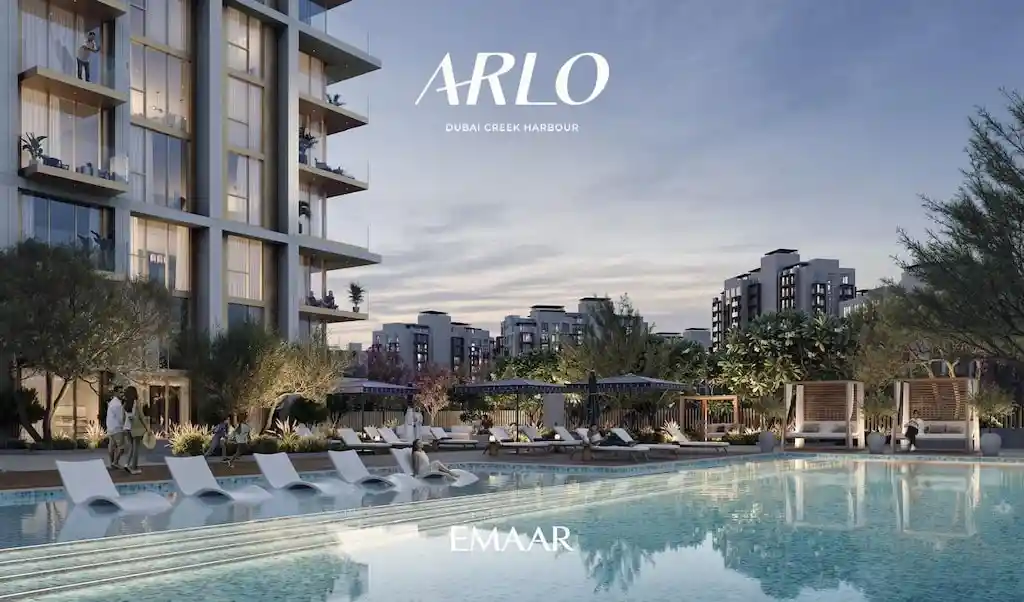

2. Dubai Creek Harbour - The Next Downtown

Why It's Heating Up:

- Dubai Creek Tower completion driving interest

- Current prices 25% below Downtown averages

- Master-planned infrastructure improvements

- Expected 2025 ROI: 7-9%

Best Buys: Creek Views apartments and Harbour Gate district

3. Mohammed Bin Rashid City - Luxury Redefined

2025 Projections:

- AED 3,500-5,500 psf for villas

- 18% price growth forecast

- Strong demand from UHNWIs

- Sobha Hartland and District One leading

Emerging Opportunity: Golf Place villas near new championship course

4. Jumeirah Village Circle (JVC) - Affordable Growth

Market Dynamics:

- Prices still 15% below 2014 peak

- Rental yields averaging 7.5-9%

- Family-friendly community expansion

- New metro line impact

Smart Play: 3BR townhouses near Circle Mall

5. Dubai South - The Future City

2025 Potential:

- Expo City legacy driving growth

- Al Maktoum Airport expansion

- Commercial hub development

- Current prices 30% below market average

Investment Highlight: The Pulse residential community

Emerging Areas to Watch

1. Mina Rashid

Waterfront revitalization project

Luxury marina living

Expected 2025 launch of new towers

2. Al Quoz Creative Zone

Arts and culture focus

Loft-style conversions

Government incentives for businesses

3. Dubai Islands (Formerly Deira Islands)

New beachfront developments

First phase completions in 2025

Affordable entry point for waterfront

Investment Strategies for Different Budgets

Budget Range | Recommended Areas | 2025 Strategy |

Under AED 1.5M | Arjan, Furjan | Buy-to-let studios |

AED 1.5-3M | JVC, Dubai South | Family townhouses |

AED 3-5M | Business Bay, JLT | Premium apartments |

AED 5-10M | Dubai Hills, Creek Harbour | Luxury units |

AED 10M+ | Palm, MBR City | Ultra-prime villas |

Key Market Drivers for 2025

- Dubai GDP growth forecast at 4.5%

- Oil price stability supporting investment

- D33 economic plan implementation

- 25% increase in millionaire migration

- Growing tech workforce housing demand

- Family office relocations

- Blue Line metro expansion

- Al Maktoum Airport progress

- New road networks

Risks and Mitigation Strategies

- Oversupply in some segments

- Interest rate fluctuations

- Global economic uncertainty

Smart Investor Approaches:

Step-by-Step 2025 Investment Guide

Why 2025 Presents Unique Opportunities

- Market maturity with transparent regulations

- Increased institutional investment flowing in

- Supply-demand balance improving

- Government initiatives supporting owners