.jpg)

Dubai Launches New Initiative First-Home Buyer in 2025

Dubai has launched a landmark initiative to make homeownership more accessible for first-time buyers, aligning with the D33 strategy and the Dubai Real Estate Sector Strategy 2033. With 10,000 new investors expected monthly and a Dh1 trillion real estate transaction target, this program offers preferential pricing, flexible payment plans, and priority access to properties under Dh5 million. Spearheaded by the Dubai Land Department, in collaboration with the Department of Economy and Tourism, the initiative offers a curated set of financial incentives, mortgage support, and procedural advantages. By tackling affordability and accessibility, the programme supports both individuals and the city’s wider growth ambitions, making it easier than ever to invest in Dubai’s real estate market.

Programme Aims to Boost Home Ownership and Real Estate Investment

This new programme has a dual purpose: to empower residents with homeownership and to stimulate real estate investment with a focus on long-term end users rather than speculative buyers. With Dubai’s population projected to reach 5.8 million by 2040, ensuring more residents can afford a home is critical to sustainable growth. Key themes of the programme include resident happiness, community development, and economic growth, all aligned with national objectives to create a more inclusive property market.

Eligibility and Benefits for First-Time Buyers

To qualify, applicants must be UAE residents aged 18 or older with a valid Emirates ID and must not own any property in Dubai. The program primarily covers apartments under Dh5 million, making it accessible for middle-income buyers.

Main benefits include:

- Priority access to new projects

- Preferential pricing on select units

- Flexible payment plans

- No restrictions on leasing or resale after purchase

- Streamlined registration via DLD website and Dubai REST app

These incentives are designed to help buyers overcome traditional financial and procedural barriers.

Collaboration Between Government and Private Sector

The programme is a powerful example of public-private synergy. Alongside government entities, over a dozen developers and major banks have joined forces to provide a seamless buyer journey. Notably, the Dubai Economic Development Corporation, led by Hadi Badri, has endorsed the initiative as a key driver of housing stability and economic inclusion. This cooperation demonstrates how policy and market forces can align to create better outcomes for residents and investors alike.

How to Register for the Programme

Buyers can apply through the Dubai Land Department’s official portal or via the Dubai REST app. The digital process is efficient, secure, and user-friendly.

Steps to apply:

- Verify eligibility as a first-time buyer

- Submit Emirates ID and residency documents

- Browse eligible projects from partner developers

- Choose payment plan or mortgage option

- Complete transaction and property registration

This integrated registration pathway simplifies the experience while ensuring compliance and transparency.

10,000 New Investors Monthly: Dubai’s Real Estate Growth

With a target to attract 10,000 new investors monthly, Dubai is scaling its ambitions to match global real estate hubs. This influx of genuine homeowners will help stabilize neighborhoods, boost community infrastructure, and support broader economic activity. The initiative is a key component of the Dubai Real Estate Sector Strategy 2033, which sets an ambitious goal of Dh1 trillion in property transactions annually. Empowering end users ensures that this growth is inclusive and sustainable.

Dubai’s Vision: Aligning with D33 Strategy

The programme directly supports the D33 strategy, Dubai’s 10-year economic agenda aimed at doubling GDP and placing the city among the top global economies. By encouraging long-term ownership, the initiative adds depth to the property sector and helps attract talent, businesses, and families who see Dubai as a place to settle, not just work or invest. This alignment makes the programme not just a housing policy, but a cornerstone of Dubai’s next phase of growth.

Flexible Payment Plans and Preferential Pricing

One of the most attractive features is the availability of flexible payment plans. These include:

- 0% to 10% down payments on select units

- Post-handover payment terms up to 5 years

- Interest-only mortgages for initial years

- Reduced or deferred registration fees

These structures remove traditional barriers to entry and offer a more manageable path to ownership—especially in new developments by Ellington, Beyond Developments, and Danube Properties, among others.

Developers and Banks Participating in the Initiative

The program is supported by a range of developers offering qualified projects. These include:

- Azizi

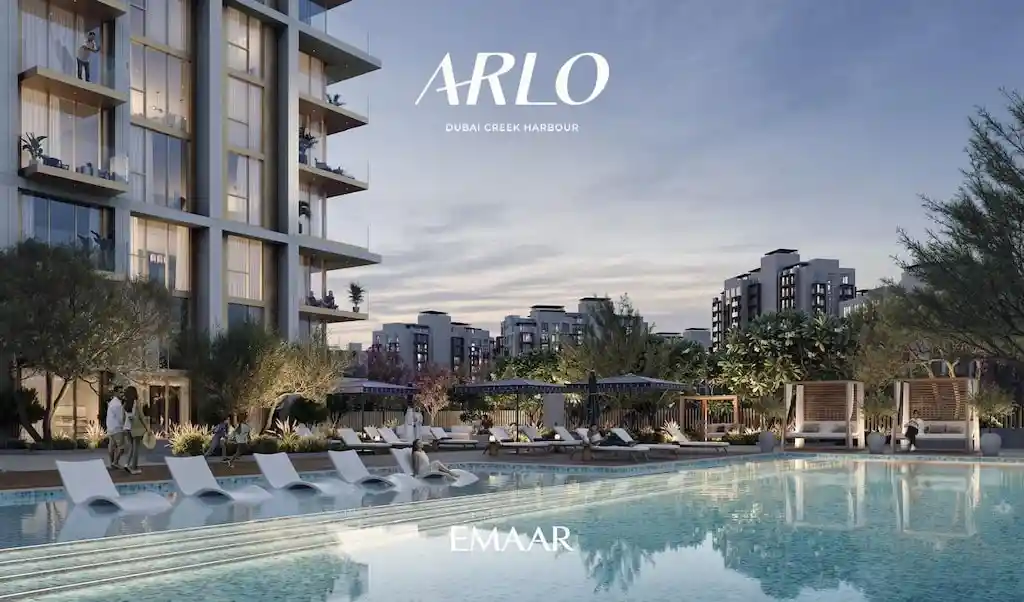

- Emaar

- Damac

- Ellington

- Majid Al Futtaim

- Beyond Developments

- Danube Properties

- Wasl

- Nakheel

- Dubai Properties

- Meraas

- Palma Development

- Binghatti

Mortgage and banking partners also play a key role. Participating banks include:

These banks are offering specialized home loan products through advisors like Mohamad Kaswani, Managing Director of Mortgage Finder, a platform helping buyers access best-fit financing.

Homeownership and Happiness: A Key Priority for Dubai

Ownership is directly linked to life satisfaction and stability. The Dubai government has emphasized resident happiness as a major policy goal, and this initiative helps deliver on that by empowering renters to become homeowners.

Multiple stakeholders have spoken out in support of the programme:

Majid Al Marri shared that Dubai currently welcomes around 10,000 new investors every month. “With this new initiative, we aim to boost those numbers even further,” he noted. He also emphasized that the emirate is targeting AED 1 trillion in real estate transactions as part of the Dubai Real Estate Sector Strategy 2033, with the ultimate goal of establishing Dubai as a global hub for property investment.

Hadi Badri, CEO of the Dubai Economic Development Corporation, highlighted the broader impact of the programme, saying: “This initiative gives the next generation a real opportunity, to invest with confidence and pride in a place they can truly call home. For many residents who have long dreamed of owning property in Dubai, now is their moment.” He added that homeownership is closely tied to personal well-being. “It creates stability, helps people put down roots, and significantly improves quality of life. In Dubai, resident happiness is a key priority. That’s why initiatives like this matter. The government sets the stage, while the private sector delivers with speed, scale, and alignment. Dubai has always been home to families from all over the world, many of whom have built lasting legacies here.”

Mohamad Kaswani, Managing Director at Mortgage Finder, echoed this sentiment, saying the initiative is a major step forward in helping residents enter the property market. “This programme is a clear reflection of Dubai’s visionary leadership,” he said. “By enabling more people to become homeowners, it supports the city’s ambition to grow its population to 5.8 million by 2040 and reinforces Dubai’s position as one of the best cities in the world to live in.” These endorsements underscore the initiative’s credibility and its alignment with Dubai’s broader housing and economic policies.

Dubai’s Goal: Dh1 Trillion in Property Transactions by 2033

Under the Dubai Real Estate Sector Strategy 2033, the city is targeting Dh1 trillion in annual real estate transactions. The path to this target includes a larger base of homeowners, reduced reliance on foreign speculation, and integrated ecosystem support from developers, lenders, and platforms. This detal is also reported by Khaleej Times. Programs like this one aren’t just about numbers, they’re about creating a resilient property market that works for residents and investors alike.

FAQs:

1. Can I buy any property under this programme?

Only select units under Dh5 million, offered by partner developers, are eligible.

2. What are the age and residency requirements?

Applicants must be UAE residents, 18 or older, with a valid Emirates ID.

3. Is financing available through the programme?

Yes. Banks like Commercial Bank of Dubai. Dubai Islamic Bank, Emirates NBD, Emirates Islamic, Mashreq offer tailored mortgage options.

4. Can I sell or rent out the unit later?

Yes, there are no restrictions on leasing or selling post-completion.

Q5: What’s the best way to start?

Work with a registered real estate firm like Eplog Off-plan to handle everything, from registering to negotiating the best deal. Contact us here.